Does Quicken Software For Mac Export To Turbotax For Mac

Software Downloads for 'Movie Magic Budgeting Mac Torrent'. Movie Magic Budgeting. License: Shareware. Movie Magic Budgeting is a powerful program that can help you design and manage multiple budget sheets. It features an intuitive, flexible format that allows users to createand edit comprehensive budgets of all sizes, for all types of productions. Budget software free download - Budget, Budget Calendar, Budget Planner, and many more programs. Enter to Search. Experience the process of making movies. Free to try User rating. Movie budgeting software free mac 2017. Download movie budgeting for free. Business tools downloads - Showbiz Budgeting by Airspeed Media, Inc. And many more programs are available for instant and free download. Movie Budget Software. Movie Budget Software tool helps to keep a detailed account of the budget for completing a whole movie. The details will be sorted out into various categories and so it makes life easier for a film production company. All the shots and scenes of the movie can be captured as per the schedule without suffering a loss.

- Does Quicken Software For Mac Export To Turbotax For Mac Os

- Does Quicken Software For Mac Export To Turbotax For Mac Pro

- Does Quicken Software For Mac Export To Turbotax For Mac Download

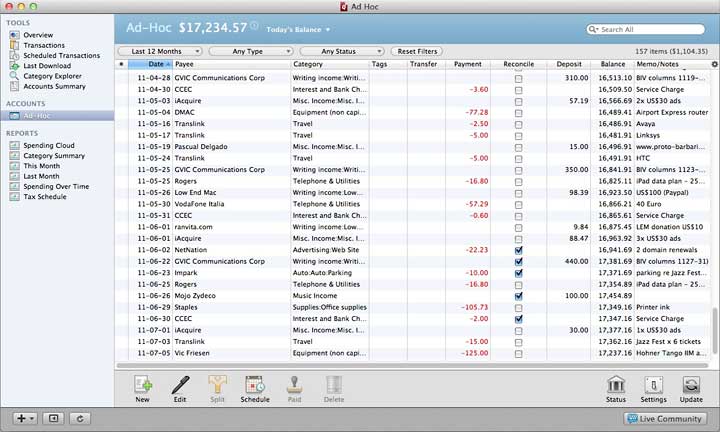

TurboTax asks for your Quicken information during the TurboTax EasyStep Interview process so, if you're using TurboTax software, you don't need to do go through a special process to import your information from Quicken. If you would like to export data to TurboTax manually or are using other tax preparation software, you can create tax schedule and capital gains reports and export them to a. December 2019. You can also do it this way on Quicken Deluxe. On the tool bar click on Planning - go to Turbotax - then pick which file you want to export Tax Schedule or Cap Gains. If I am not mistaken doing it this way the file you export right now will show data for 2018 not 2019. Oct 25, 2019 For years, Quicken has been one of the oldest and most reputable personal finance tools, but Quicken for Mac has always been lacking in the features department compared to its Windows counterpart. Fortunately, over the past four years, Quicken for Mac has been making updates to bridge that gap. Apple users have high standards because we’re used to clean and intuitive software.

Does Quicken Software For Mac Export To Turbotax For Mac Os

Nov 13, 2016 Anyone download the newly released 2017 version? I'm still using QM2007. 'Quicken 2017 for Mac continues to add the top user-requested features. Here are the latest improvements: Compare your income and spending year over year with custom reports Customize your budgeting goals month-by. One of the biggest news items in the personal finance software. Space for 2015 was the releasing a new version of Quicken for Mac. The last time there was a true update for Quicken for Mac was in 2007. Quicken Essentials for Mac was released after that, but no one really takes that app seriously.

Home›Quicken for Windows›Investing (Windows)Best Answer

- Accepted AnswerFor tax estimates I have started using the Tax Planner in Quicken, which has been improved and updated this year.1

Does Quicken Software For Mac Export To Turbotax For Mac Pro

Answers

Does Quicken Software For Mac Export To Turbotax For Mac Download

- I followed the instructions and created the report. After selecting the export icon, I try to save it as an .XTF file but it only it gives me the following options: .xlsx .txt and .pdf. According to the help documentation I should be able to export it to a .XTF file but there dose not appear to be a way to do that.

- Are you referring to a .TXF file? In that case select 'Report to tax export file.'

- Why do you want to do this -

and where or what will you do with the exported file ?0 - I am using H&R block tax software and I want to be able to import the data from Quicken in the form of a (standard) .txf file.

- Tom, pardon my typo, yes I am talking about an .TXF file. If you read my initial comment, I am not being given the option to Report to tax export file. Please read my initial comment.

- edited December 2019Reports > Tax > Tax Schedule

--Check that the data is correct --

Click on the Export icon at the top (sheet of paper with a green arrow)

Pick Report to tax export file

Repeat with Reports > Tax > Capital Gains

or, go to File > File Export and initiate the exports from there, but then you don't get a chance to review the data.

[Someone edited the title of your post to TXF)0 - Guessing this scenario... using QW 2020 DLX R23.17 -From Quicken: Reports -> Tax -> Tax Schedule -> Export -> Report to tax export file.

That will create a .TXF file, and the rest you need to get from H&R on how to import it.EDIT -- I also updated the topic title to better reflect the actual Q&A1 - and after generating the report you click on Export:and the 3rd option isn't listed?

- edited December 2019In QWin - from the menu bar;

File > File Export > Export TurboTax Tax Schedule Report

and/or

File > File Export > Export TurboTax Capital Gains Report

These are the txf files for import into TTax or other compatible tax software.QWin & QMac (Deluxe) Subscription

Quicken user since 1991 - I want to thank all of you for your responses. I believe I have it now.

Many thanks. - On the tool bar click on Planning - go to Turbotax - then pick which file you want to export Tax Schedule or Cap Gains.

If I am not mistaken doing it this way the file you export right now will show data for 2018 not 2019.The only way for you to get this years numbers is to set your computer clock any date after Jan 1, 2020. Just remember where you saved the file.Now you can import into H&R Block per their software instructions.Quicken Windows Deluxe (Subscription)

Windows 10 Pro 1903 - FWIW I do not export Quicken data to TurboTax because I want to reconcile it with the 1099s and W2s I receive and because there is important tax information that Quicken does not collect.

For example Quicken does not distinguish between ordinary and qualified dividends, does not handle foreign taxes paid, etc. Much of this data is only available on the 1099 forms and not throughout the year.0 - @Jim_Harman

I do export it to a draft or test file for a guesstimate. I also wait for the 1099's and any other tax documents. This early in the tax season not all forms are ready any way.

Turbotax and H&R Block all will show Draft, plus IRS has not even set a date to when they will start to accept the1040's.Quicken Windows Deluxe (Subscription)

Windows 10 Pro 1903 - Thanks Jim. My goal is to do a preliminary return before the end of the year in order do see what I might have to adjust.

- Accepted AnswerFor tax estimates I have started using the Tax Planner in Quicken, which has been improved and updated this year.1

- edited December 2019I also updated my methods for Quicken handling income. like paycheck, etc.Normally, I would just see the net amount being deposited, but then, after being mentioned in another thread, I ran across the PAYCHECK form of a Reminder.So now, I enter ALL the info from my paystub so that the taxes are now correctly reflected in the Quicken Tax Planner.I even went back thru all the checks and re-entered them via the Paycheck template so the withholding and other taxes matched the paystub YTD.0

- edited December 2019

I agree 100%. For me, at least, there are 2 things which have, in the past, been worthy of import from Quicken: charitable contributions and state & local taxes. Nothing else is really accurate enough to be usable.FWIW I do not export Quicken data to TurboTax because I want to reconcile it with the 1099s and W2s I receive and because there is important tax information that Quicken does not collect.

For example Quicken does not distinguish between ordinary and qualified dividends, does not handle foreign taxes paid, etc. Much of this data is only available on the 1099 forms and not throughout the year.

I only hope one day those things will be fully deductible again, so I continue to track them and import them to TT.Quicken user since version 2 for DOS, now using QWin Premier Subscription on Win10 Pro.